Note Jan 2026: Looking back over the last two months, the changes were only momentary. The RAM prices got worse and now significantly worse. For the next couple of years, better to stop rewarding this price manipulations and not buy anything. I am happy with the compute and DRAM that I own.

Nov 2025:

Through late summer, RAM prices moved fast not in the good direction. Between early September and mid-October 2025, some DDR5 SKUs tripled in price within a few weeks. The explanation was familiar: AI demand, high-end server builds, and an industry convinced that anything labeled “AI-ready” would stay scarce for months. The rhetoric from vendors and analysts was that prices wouldn’t come down anytime soon. For instance, one report noted DRAM contract prices rose by 171.8% year-over-year as of Q3 2025, citing AI-driven demand. Part of the earlier surge came from DDR4 production cuts, but most of it traces back to overconfidence in AI hardware demand. Memory suppliers stockpiled, redirected supply toward data-centers, and throttled consumer availability, expecting continuous orders from GPU-heavy infrastructure projects. The problem is that not all of that demand materialized or at least not as fast as the forecasts assumed. Supporting this, industry analysts warned DRAM prices were unlikely to drop soon, driven by the explosion in AI-data-center build-out and structural memory shortages. Here is a direct quote:

“Memory prices are set for an increase in Q4 of 2025, according to market watcher TrendForce, which points the finger at the three top DRAM makers – Samsung, SK Hynix, and Micron Technology. These suppliers are allocating advanced process capacity primarily to high-end server DRAM and HBM, which is constraining their capacity for PC, mobile, and consumer chips.”

The Register, September 24, 2025

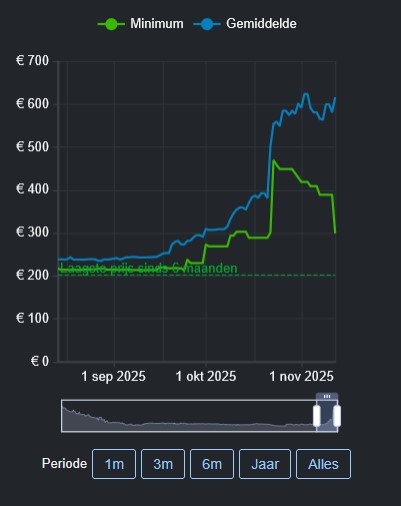

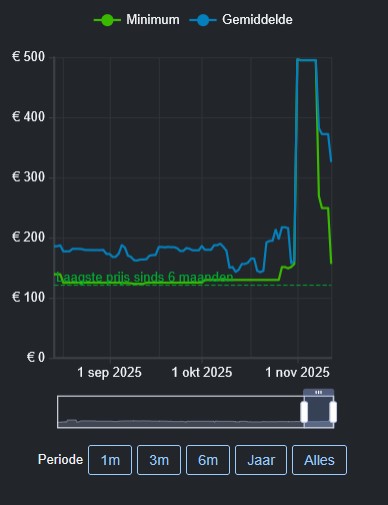

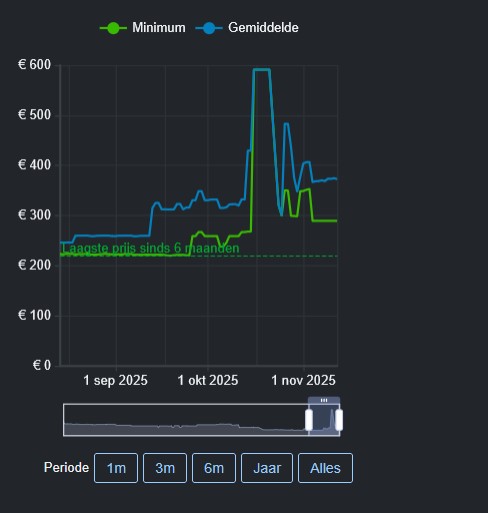

Now, in the first two weeks of November, we’re finally seeing the first signs of a correction. In the Netherlands, memory prices tend to trail larger markets like Germany or the US. But even here, we’re already seeing visible drops. That usually signals a broader shift still underway upstream. If so, the next few months could bring a more meaningful correction. Prices have dropped around 25-30% across most DDR5 SKUs and some as high as 51%. They’re still higher than historical averages, but the trend is shifting. Even the higher-end kits that looked untouchable a month ago are starting to move.

Here is some data from tweakers.net

I also noticed the increase a trend in third party sellers selling RAM at lower prices in the last few weeks. Either they are selling used DRAM, or they have seen the price decrease incoming and making some money beforehand or there is some other mechanism in hand here. In supply chains, when the curve bends down this sharply, it usually means stock-rooms are full. Vendors start releasing inventory quietly, prices soften, and the “shortage” narrative begins to fade. If AI spending continues at a slower pace than expected, the market will likely rebalance faster than the industry wants to admit.